-

Who we are?

-

What we can?

ServicesIndustries

Attorney firm GORO legal recommended by prestigious international rankings LEGAL500, Who is Who Legal and Benchmark Litigation Europe

- Why we are

- Contacts

Escrow accounts by the eyes of the bank and customers. Problems and opportunities for use

27 / 04 / 2018

General information on escrow regulation

PACTA SERVANDA SUNT (lat. “A deal is a deal”) is relevant at all times and for the level of development of social relations, since the norms of coercion or the force in their promising action are most often opposed and conversely, the mutual respect and trust are the basis and necessary prerequisite for the development of correct and effective legal relations between all interested participants.

Unfortunately, the existence of a pure trust relationship that is not supported by the measures to ensure the implementation

of agreements in the practical and law-enforcement area, has been nominal for a long time, and each party to the agreement wants to protect their rights and interests from the potential violations by the other side as effectively as it is possible, the risk of such violations occurs in most situations.

The measures to ensure the proper performance of the obligations and the instruments used are diverse but not cross functional. The advantages and disadvantages of the charge, guarantees, retention, etc. in the scientific and practical environment were studied and the conclusions were made.

The search for the more convenient and efficient mechanisms, which give uncomplicated and equally effective way to provide each party of the obligation with equal opportunities for proper performance of the obligation and equal levers of the passive influence on the outcome of such obligation between its parties, led to the introduction of the escrow institution in Ukraine - conditional keeping of cash assets known as the escrow account.

The specified instrument in its pure form is a novel of the domestic legislation; however, it is not new for other countries of the world, which have been successfully applying it for a long time. In fact, the term “escrow” (“escrow” is a small piece, cut, single parchment) traces the lineage to the XVI century A.D. It meant making a deposit to the certain third (independent) party and such deposit was in the possession of the disinterested party before the other party will fulfill its obligation.

In accordance with the Article No. 1076 of the Civil Code of Ukraine, which appeared in the Code due to the Law of Ukraine “On amendments to certain legislative acts of Ukraine regarding the improvement of corporate governance in joint-stock companies” dated March 23, 2017 No. 1983-VIII that entered into force on June 04, 2017, according to the escrow agreement the bank undertakes to accept and transfer to the escrow account, which was opened to the client (account holder), the funds received from the account holder and / or from the third parties, and to transfer such funds to the person (persons) indicated by the account holder (the beneficiary or beneficiaries), or return such funds to the account holder upon the occurrence of the circumstances stipulated in the escrow agreement.

Thus, the role of the escrow agent is assigned exclusively to the banks, since the object of the deposit is exclusively monetary means, which are credited and blocked in the special escrow account.

International practice of escrow

In the United States of America, Sweden, Denmark, other economically developed countries, escrow is a popular way of securing the liabilities. Thus, in the United States of America, the escrow account is used by the parties to the agreements related to real estate (in particular, mortgage loans, where the mortgage company establishes the deposit account for paying (transferring) the property tax and property insurance). The escrow accounts are also used for the sale (transfer) of the valuable information and property, especially in case of agreements, which are accepted remotely.

In the UK, the escrow accounts are often used during private property transactions to store customers’ money, such as the deposit, until the transaction will be completed.

Advantages and options of escrow account

In Ukraine, the use of escrow accounts will become increasingly popular and field of application, taking into account the convenience of such instrument. At the same time, the escrow account transactions are precisely the method of the settlements between the interested parties at the legislative level.

The advantages for banks acting as such agents are obvious.

First of all, it is the attraction of the resource and the possibility of its usage during the period, while it stays at the bank, and guaranteeing the timely transfer of such funds to the beneficiary (beneficiaries) or the return of such funds to the account holder in accordance with the terms and conditions of the escrow agreement, if the usage is not specified in the escrow agreement.

Secondly, the remuneration for carrying out the escrow account transactions, depending on the amount and complexity of the actions carried out by the bank, can be set by the bank at an appropriate and interesting level for itself, which increases the commission income to the bank.

The new customers engagement is also an obvious advantage for the banking institutions, since by providing the banking services for the escrow account maintenance at a high-quality and professional level, the bank has all possibilities to leave a satisfied customer (both the account holder and the beneficiary) for the further servicing with the rendering other banking services.

For bank customers and their beneficiary counterparties, making the settlements between themselves using escrow accounts is a convenient option and sufficient and affordable way for the timely and complete execution of pecuniary obligations between such parties.

At the same time, such interested in using the escrow account parties should keep in mind the following points.

Thus, all conditions for the receiving funds by the bank to the escrow account, crediting, transferring to the beneficiary or returning to the account holder must be specified specifically in the escrow agreement. In connection with the mentioned points, the parties to the transaction need to be scrupulous about the issues of the accuracy of settling all amounts, terms, account details, cases of bank transfer of funds to the beneficiary or their return to the account holder, which will be specified in the escrow agreement, as the bank will fulfill this agreement and its terms and conditions, rather than for example, an asset purchase and sell agreement, etc.

The escrow agreement is a bilateral agreement (bank - client), if the participation of the beneficiary as a third party has not been agreed in advance.

Unless otherwise provided by the escrow agreement, neither the account holder nor the beneficiary shall have the right to manage the funds, which are stored on the escrow account.

The timeliness and objectivity of the settlement of the escrow account by the bank are guaranteed by the bank’s predetermined procedure for checking the actual occurrence of such circumstances as stipulated in the agreement, as well as the extent to which the bank conducts such verification - checking documents only by the external signs (account details, signatures, etc.) or deeper, which includes requesting the additional documents, legal analysis of the documentary evidence of such grounds for transferring funds, etc.

The advantage of using the escrow account, whereof is already “loudly silenced”, is the inaccessibility of such funds for other persons. Thus, according to the Article No. 1076 of the Civil Code of Ukraine, enforcement and (or) seizure of funds on the escrow account, the obligations of the bank, where the account is opened (including in the event of its liquidation) are not allowed, except for the amount of funds on the account that the bank has the right to withhold as a fee as of the date of enforcement or seizure under the escrow agreement.

The enforcement and / or seizure of escrow account balance are not allowed for the obligations of the account holder or the beneficiary (including in the event of their liquidation). At the same time, the enforcement and / or seizure of the right to claim the account holder or beneficiary to the bank are allowed on the basis of the escrow agreement, including the right to claim payment of the funds (or the part of funds) that are on the escrow account, upon the occurrence of the circumstances specified in the escrow agreement.

In fact, there is no possibility of free usage of such funds for the repayment of other obligations (monetary claims) of the customer, including in the procedure of arrest, forced debiting of funds, as is possible for current and deposit accounts.

The rights and guarantees of the beneficiary regarding the observance of its interests and the fulfillment of the monetary obligation by transferring funds from the escrow account in its favor are determined by the impossibility of making amendments to the concluded escrow agreement without its knowledge or consent, even if such beneficiary was not a party to the agreement (except for the cases of making amendments, which do not limited rights of the beneficiary).

Escrow: deals and participants

Such deals are well known to Ukrainian lawyers, especially with regard to the sale of especially valuable assets. But in order to use such instrument, before they had to apply foreign jurisdictions, non-residents and foreign banks.

The Purchaser of an asset. The person, who plans to purchase the asset, deposits the funds at the bank to pay for the asset.

The Seller of the asset. The owner or representative of the asset. It may also be the recipient of the funds. In case of the deal, he performs actions aimed at transferring the right to the asset to the purchaser. He can receive the documents that he submits to the bank for making the payment.

The Beneficiary. The person in respect of whom the escrow bank makes the payment. As a rule, such person is the purchaser of the asset. However, the parties may provide for payment of the part or the entire payment in the interests of the third party (beneficiary).

The Escrow agent. Involved by the parties to the deal person, who temporarily stores the documents, funds and other materials on behalf of both parties to the agreement. After fulfilling the terms and conditions of the agreement by the parties in full, the escrow agent transfers the abovementioned materials in accordance with the terms and conditions of the agreement. It may also be the person responsible for the completion of the documentation that is submitted to the bank for payment. In some countries, the activity of the escrow agent is the subject to licensing.

The Escrow Bank. The bank in which the parties opened the escrow account with the conditions. In some cases, the escrow bank can perform the function of the escrow agent, verifying that the party has fulfilled its obligations. The bank is responsible for the safety of the funds.

The Bank of seller. When the bank is chosen by the purchaser, the escrow bank may differ from the seller’s bank. In this case, the escrow bank sends the payment to the seller’s account at such bank.

When and how to make such escrow deal?

You can perform the escrow deal and use the escrow account in the variety of ways. Consider some of them.

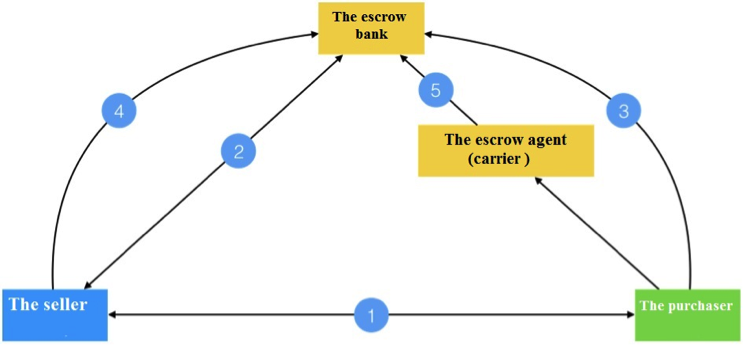

Sale of goods remotely

The parties to the deal are at the distance from each other. The goods are the physically tangible assets that require the transportation. The carrier may also be involved in such deal.

Suppose that the parties have agreed on the sale of goods. The seller wants to be sure that the money will be transferred. The purchaser wants to be sure that the goods will be delivered. Having decided on the method of delivery of the goods and understanding that the seller (or the carrier) has the title deeds, the parties can agree on the following:

- The parties make the deal and describe in detail the terms of payment - with which documents the bank makes the payment (1). In the case of goods, these may be the title deeds for the carrier or the documents on the transfer of goods to the carrier;

- Open the escrow account at the bank, describing in detail the documents that will be provided to bank for making the payment (2);

- The purchaser deposits funds in the escrow account (3);

- The seller transfers the goods to the carrier and the carrier delivers the goods;

- The seller comes to the bank with the necessary documents, provides such documents and makes the payment (4). Also, the carrier may transfer the documents to the bank (5). Thus, he can partially perform the function of the escrow agent - the delivery of the documents required for payment;

- The escrow bank transfers the funds in favor of the seller of the goods (beneficiary).

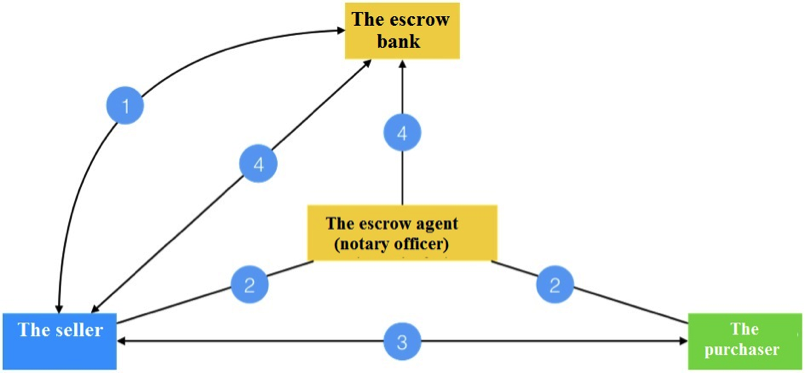

Sale of real property

The goods: real estate, requiring registration of the ownership in the registry. The notary and broker are involved in the deal.

The parties agreed on the sale of real estate. The seller wants to be sure that the money will be transferred and the purchaser wants to be sure that the property will be re-issued. There may also be the concerns about encumbrances on one of the parties, real estate, etc., which casts doubt on the completion of registration of title to real estate for the purchaser. The deal is the subject to notarization. And the ownership of the property transfers after the notarization of the agreement. In the deal the broker (brokers) may be involved on the side of the seller and / or purchaser.

Possible algorithm of the deal:

- The parties determine the escrow bank and the escrow agent;

- The escrow-bank opens an account for the deal with payment after the receipt of documents confirming the registration (transfer) of the ownership of purchaser (1). The parties can determine the person, who will provide the bank with necessary documentation for payment (the escrow agent). It can be the seller himself, the broker, the notary (2);

- The purchaser and the seller sign the notarial agreement of sale and purchase (3). The documents on the real estate can

be kept by the escrow agent (broker, notary). The notary registers the title to the purchaser;

- The seller or the escrow agent submits the documents to the escrow bank for making the payment (4);

- The escrow bank transfers the funds in favor of the seller of real estate.

The parties may also provide for the possibility of paying other expenses from such escrow account. For example, business expenses, notary fee, taxes, etc. In this case, not only the seller, but also other persons (beneficiaries) can be recipients of the funds.

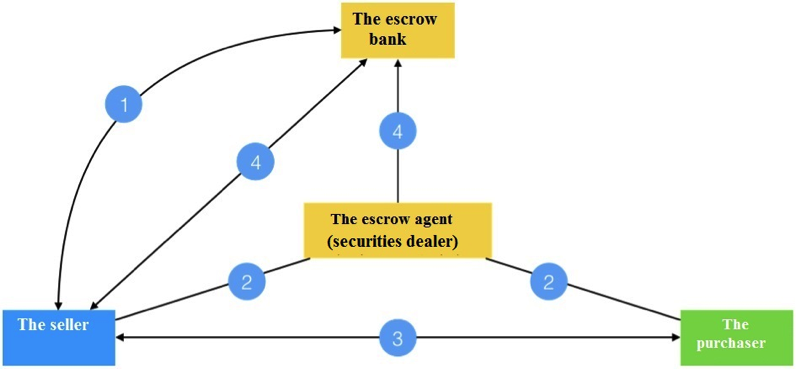

Securities sales

The goods: the securities. The securities dealer is involved in the deal.

The parties agreed on the sale of the securities. The seller wants to be sure that the money will be transferred and the purchaser wants to be sure that the securities will be credited. The deal is not the subject to notarization, however, the mandatory participation of the securities dealer is provided.

Possible algorithm of the deal:

- The parties determine the escrow bank and the escrow agent;

- The escrow bank opens an account for the deal with payment after the receipt of documents confirming the transfer of securities to the purchaser's account (1). The parties can determine the person, who will provide the bank with necessary documentation for payment (the escrow agent). It can be the securities dealer or purchaser's custodian (2);

- The purchaser and the seller sign the securities sale and purchase agreement (3). The documents on the securities can be kept by the escrow agent (securities dealer);

- The seller sends an order for the transfer of securities to the purchaser's account;

- The seller or the escrow agent submits the documents to the escrow bank for making the payment (4);

- The escrow bank transfers the funds in favor of the seller of the securities.

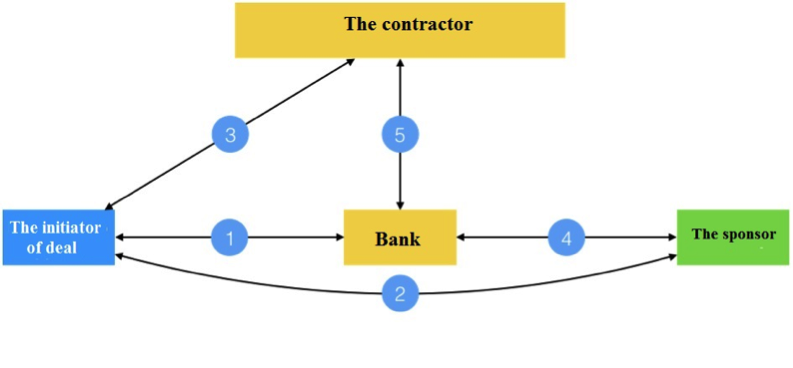

Raising funds to finance community or charity projects

The goods: goods, works or services necessary to achieve the social effect. Such goods can be the following: treatment, crowdfunding, social investments. The purpose of the deal is to achieve a non-commercial (social) effect. Source of funds: the contributions from the third parties.

The raising of the funds is organized by the initiator of the deal: a private individual, a public organization (PO) or a charitable foundation (CF). The recipient (beneficiary) of the funds may be a contractor (medical center, construction organization, supplier of the goods).

The initiator of the deal decides to raise the funds to finance the purchase of goods. To achieve the goal, the initiator of the deal organizes a campaign to promote the goal and goods. The initiator of the deal enters into agreement with the supplier of goods (medical center, construction organization, supplier of the goods). The supplier of goods will be the recipient (beneficiary) of the funds collected from the third parties.

Possible algorithm of the deal:

- The initiator of the transaction determines the escrow bank;

- The escrow bank opens an account for the deal with the payment after collecting the required amount, and also controls that the funds will be spent exclusively on the purchasing of the goods (1);

- The initiator of the deal promotes the fundraising (2);

- The initiator of the deal enters into agreement with the contractor - the recipient (beneficiary) of the funds (3);

- The third parties (sponsors) perform the payments to the escrow account (4);

- After collecting the required amount of the funds, the escrow bank transfers the funds to the beneficiary (5).

If it is impossible to collect the funds, all collected funds may be returned to senders or sent to finance other (predetermined by the terms and conditions of the deal / agreement) projects.

Return of debt secured by the mortgage

The seller of the asset has a debt. The debt is secured by the goods for which there is a purchaser. The mortgagee of the goods wants to control the deal in general and the movement of funds in particular.

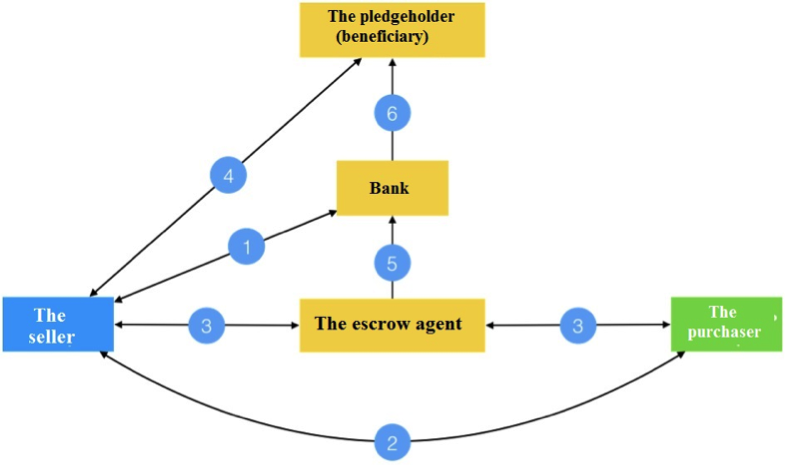

Possible algorithm of the deal:

- The parties and the pledgeholder (beneficiary) determine the escrow bank;

- The escrow bank opens an account for the deal with payment in favor of the pledgeholder (beneficiary) (1);

- The seller of the asset enters into agreement with the purchaser of the asset (2);

- The parties can determine the person, who will provide the bank with necessary documentation for payment (the escrow agent). It can be the securities dealer or purchaser's custodian (3);

- The pledgeholder agrees to the deal (4);

- The parties may involve the escrow agent to collect the documentation package required by the bank for making the payment. Such agent, depending on the goods, may be: a notary, a securities dealer, a broker or the bank itself;

- The seller, either the purchaser or the escrow agent, provides the escrow bank with the documents for making the payment (5);

- The escrow bank transfers the funds to the beneficiary (6).

The above list of possible options for the use of escrow accounts is not limited. By analogy with the abovementioned options, this instrument is suitable for any deals, where is no trust between the parties.

Based on: Lawyer & Law. The analytical edition